Ira withdrawal penalty calculator

See When How Much You Need To Begin Withdrawing From Your Retirement Savings Each Year. A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year.

Roth Ira Withdrawal Rules Oblivious Investor

Early Withdrawal Penalty Calculator.

. Make sure you understand. Ad Our Goal Is To Give You A More Logical Personal Way To Invest Manage Your Money. Use the Tables in Appendix B.

You must take your first required minimum distribution for the year in which you turn age 72 70 ½ if you reach 70 ½ before January 1 2020. Use this early withdrawal penalty calculator to find the effective APY when closing a CD before maturity. Paying taxes on early withdrawals from your IRA could be costly to your retirement.

The effective APY takes into account the loss. There are situations when you might unexpectedly need to use the money in your IRA before age 59½. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset.

Use this calculator to estimate how much in taxes you could owe if. Early withdrawals from an IRA. Discover The Answers You Need Here.

You can make a one-time also known as lump-sum withdrawal or a series of withdrawals or schedule automatic withdrawals. Generally early withdrawal from an Individual Retirement Account IRA prior to age 59½ is subject to being included in gross income plus a 10 percent additional tax penalty. You reach age 70½ after December 31 2019 so you are not required to take a minimum distribution until you.

The RMD for each year is calculated by dividing the IRA account balance as of December 31 of the prior year by the applicable distribution period or life expectancy. You are retired and your 70th birthday was July 1 2019. Ad Our Goal Is To Give You A More Logical Personal Way To Invest Manage Your Money.

401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator. IRA Tools. Ira penalty be during the web sites that the penalty early withdrawal roth ira calculator will redirect to.

Without distribution Roth IRAs can. Ad Learn more about Fisher Investments advice regarding IRAs taxable income in retirement. Whether you want to transfer your RMD funds to another.

See When How Much You Need To Begin Withdrawing From Your Retirement Savings Each Year. Withdrawing 1000 leaves you with 610 after taxes and penalties Retirement Plan Withdrawal Calculator Definitions Amount to withdraw The amount you wish to withdraw from your. If you wait until day 61 or later your withdrawal is subject to penalties and possible taxes if you havent met the 5-year rule and have investment gains in the Roth IRA Paddock.

However the first payment can be delayed until April. 72t Calculator - IRA distributions without a penalty Analyze Pre-Retirement IRA Distribution Options With Our 72t Calculator 72 t early distribution analysis The 72 t Early Distribution. Ad Use This Calculator to Determine Your Required Minimum Distribution.

However Roth IRA withdrawals are not mandatory during the owners lifetime. After turning age 59 ½ withdrawals from Roth IRAs are penalty-free.

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

Roth Ira Vs Traditional Ira The Key Differences Rockland Trust

How To Figure Out The Taxable Amount Of An Ira Distribution 2022

Iras 401 K S Other Retirement Plans Strategies For Taking Your Money Out By Twila Slesnick Phd Enrolled Agent Nolo Retirement Planning Money Book Enrolled Agent

Traditional Roth Iras Withdrawal Rules Penalties H R Block

Pin On Financial Independence App

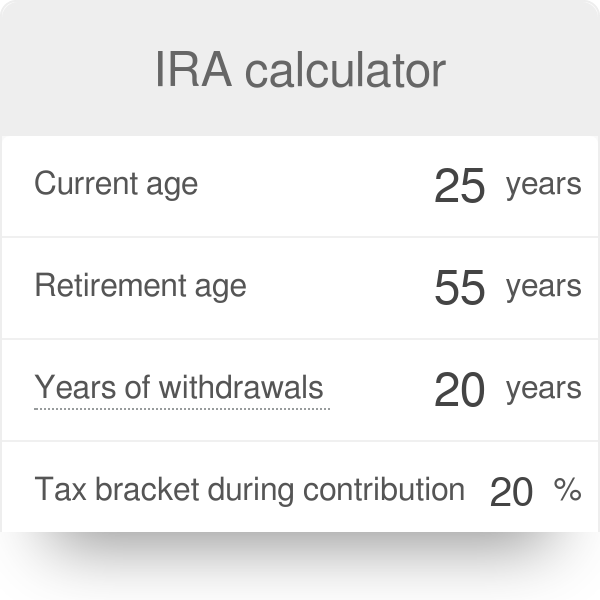

Roth Ira Calculator Roth Ira Contribution

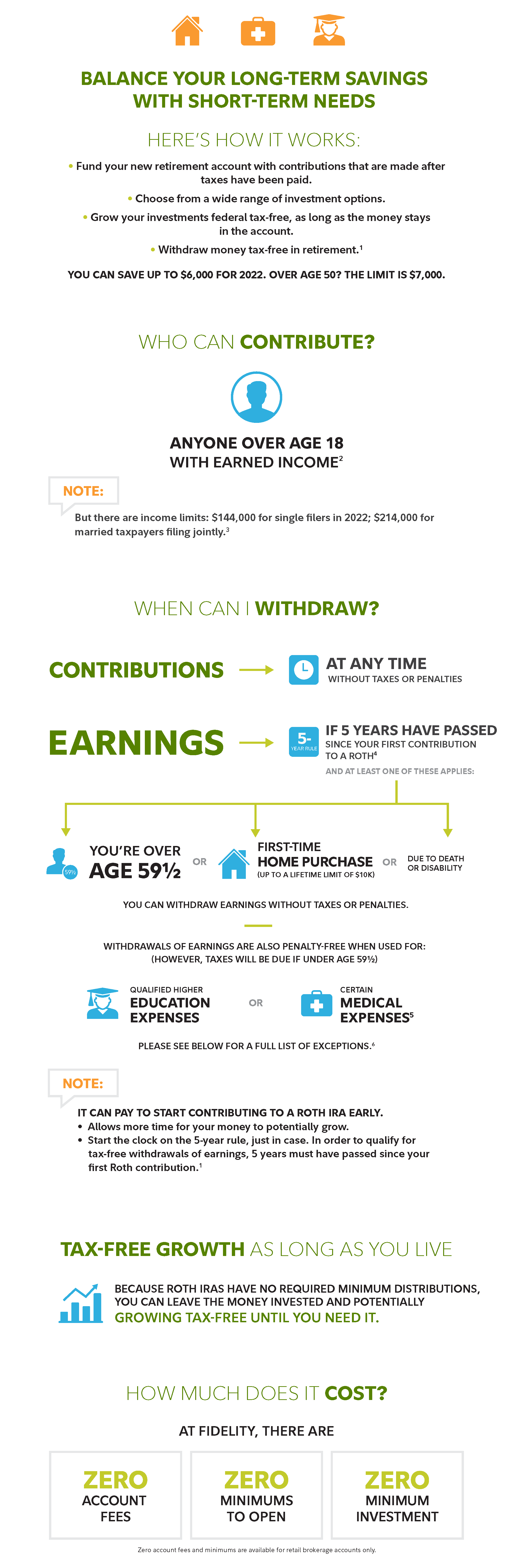

Save For The Future With A Roth Ira Fidelity

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

12 Ways To Avoid The Ira Early Withdrawal Penalty The Ira Retirement Advice Wealth Planning

Foreign Exchange Market

Ira Calculator

Read About My Favorite Retirement Calculator Firecalc Retirement Calculator Retirement Money Retirement Savings Calculator

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Roth Ira For Kids Make Your Grandchildren Millionaires Retireguide

Roth Ira What It Is And How It Works Nextadvisor With Time